“By the work, one knows the workman.” – Jean de la Fontaine (1621 ‑ 1695)

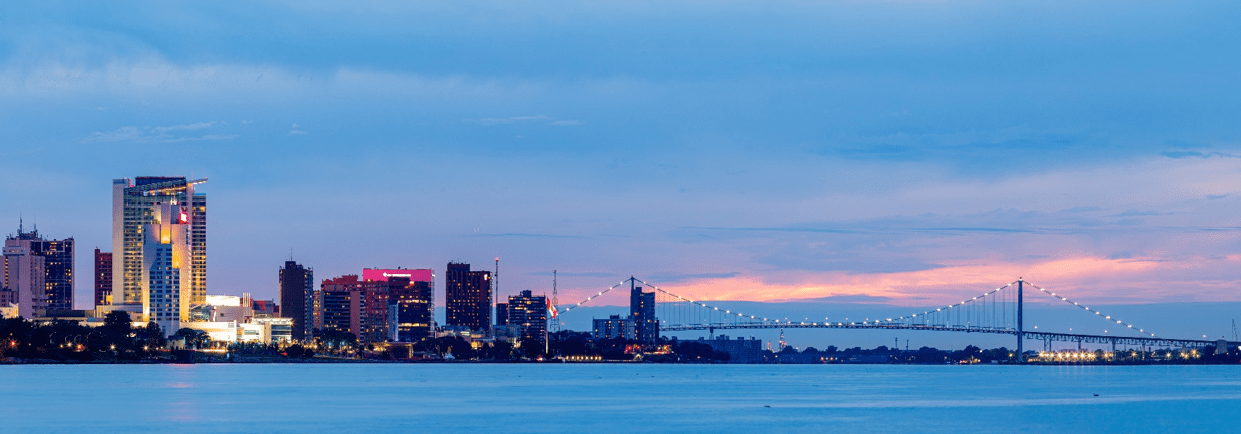

Welcome to Gregory D. Garant, CPA for Financial Services in Windsor

Gregory D. Garant, CPA has been providing a wide range of financial services in Windsor, including accounting, taxation, auditing and business advisory services to Canadian and American clients throughout the US and Canada since 1989. We are a team of five full-time individuals, all of whom are familiar with Canadian and US tax preparation.

Our focus is on assisting individuals and small to medium-sized corporations, helping to maximize their profits while minimizing their income taxes.

Our services include:

Canadian income tax preparation

Accounting and auditing services

- Financial statements

Business advisory

- Start-up

- Projected cash flow statements

- Financial assistance

Extended Hours and Flexible Methods of Filing

In recognition of the busy and varying schedules of our clientele, we offer both extended hours and alternative methods of filing.

Extended Hours

Year-round

8:00 AM to 5:00 PM. Monday to Friday, with evening and weekend appointments available

Tax season (February – April)

8:00 AM to 8:00 PM, Monday to Friday

9:00 AM to 5:00 PM, Saturday

Alternate Methods of Filing

Since face to face appointments are not always convenient or possible, we offer email and tax-by-fax options.

Our Clients

Gregory D. Garant serves a wide array of personal and corporate clients in the US and Canada seeking accounting, auditing, bookkeeping, income tax preparation, business advisory and more. Whether you are a US citizen working in Canada, a Canadian Citizen working in the US, a business owner from the US who own businesses in Canada, or a Canadian who owns businesses in the US, our team at Gregory D. Garant can always help you with our financial services. Give us a call today to know more.

Effective Tax Strategies

With our effective tax strategies, you get the following benefits:

Get IRS credits such as Earned Income Tax Credit, Saver’s Credit and more to reduce tax.

Shoot for long-term capital gains such as investing in mutual funds, bonds, real estate.

Buy municipal bonds to receive your original investment as the bond reaches maturity date.

Create additional income, such as start a business to reduce tax on utilities, internet and much more.

Maximize your tax deduction by collecting, recording and filing receipts for all your purchases that are or may be business-related.